Study: How mega trends influence society

- Study commissioned by Erste Asset Management and conducted by Integral: the effects of digitisation on society are regarded as ambivalent

- 44% of Austrians consider digitisation as one of the biggest drivers in society

- Environmental and social sustainability is important to 79% of the respondents

- New fund ERSTE FUTURE INVEST covers the most important mega trends

Digitisation, energy transition, climate, and globalisation. Omnipresent buzzwords in constant usage nowadays. When mega trends are quoted in connection with investments, the reference is often to topics and developments that can facilitate significant social change.

How can the standard of living be kept in the future? What are the growth regions, and what forms of innovation and technological developments promise well for the years and decades ahead? 44% of Austrians regard digitisation as the biggest driver of society, closely followed by technological progress for example in medicine and Big Data (43%).

Only about a third considers automation (33%) or energy transition (29%) as strongly influential. According to a representative study by Integral, commissioned by Erste Asset Management (Erste AM), demographic changes only worry about 18% of the respondents.

Majority of respondents can see positive effects of mega trends on their lives

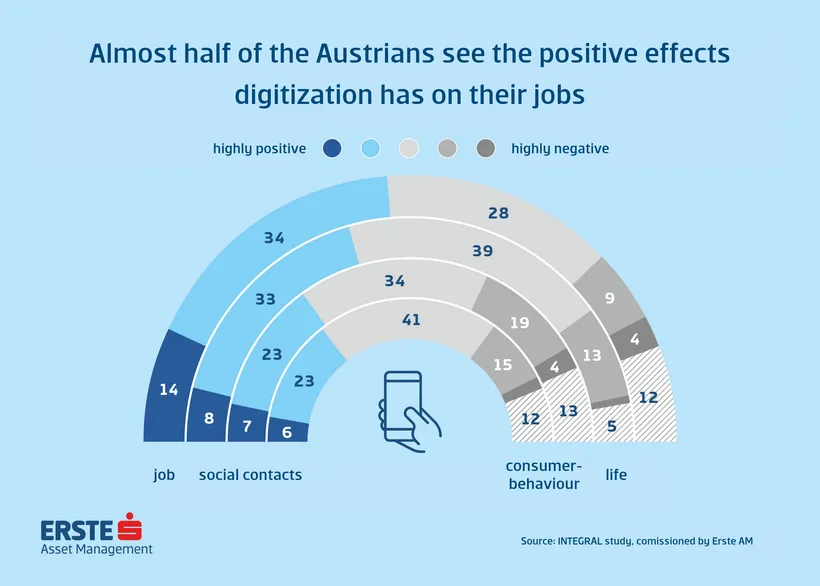

41% of Austrians can basically see a positive effect of digitisation on their lives, with only 14% worrying over a negative impact. In particular, respondents in the age bracket of 16 to 29 believe that digitisation will have a rather positive or very positive effect on their job and social contacts.

“There is a good reason why mega trends hold a high profile in public perception. We are at the outset of exciting developments: sustainable sources of energy, autonomous cars, artificial intelligence or virtual reality in the industrial and medical sector already show their enormous potential,” as Heinz Bednar, CEO of Erste AM, points out.

Mega trends and sustainability are the driving forces on the markets

Topics such as automation, the internet of things, or artificial intelligence illustrate the fact that new business models have emerged whose economic potentials have not yet been fully exhausted by any stretch of the imagination.

“The technology sector provides without a doubt the strongest impulses. Ground-breaking developments are imminent in information technology, biotechnology, and environmental technology,” explains Gerold Permoser, Chief Investment Officer Erste AM. The constantly growing world population and its huge leaps in lifestyle habits are the main driver of technology.

According to the UN, there might be 10 billion people on Earth by 2050 (2019: ca. 7.7 billion). Climate change and the constantly growing world population demand an alternative to traditional forms of energy. In addition to new sources such as wind and solar power, industries around themes like energy efficiency and energy supply (intelligent grids) are emerging. Sustainability is therefore important to 79% of Austrians (according to their own declaration) in an ESG context (environmental, ethical, social).

Investing in mega trends

Erste Asset Management has just initiated the subscription phase for the ERSTE FUTURE INVEST fund. This is an actively managed equity fund: selected individual shares or specialised equity funds cover five specific mega trends.

Given that mega trends do not follow typical patterns, the investment strategy of the fund is actively managed on this basis. The allocation into equities and funds is adjusted on an ongoing basis as well; the portfolio will focus on attractive, but – to many investors – little known mid-cap companies in addition to blue chips.

“Not every hype or trend turns into a mega trend. A mega trend is a development that should last for many years. We are talking about 15 years or more, maybe decades,” as Permoser concludes.

INFO:

The new equity fund ERSTE FUTURE INVEST invests in five potential mega trends such as healthcare, lifestyle, technology & innovation, environment & clean energy, and emerging markets that are considered attractive for investors. The experienced fund management team of Erste Asset Management monitors and assesses mega trends and invests in them either through selected individual shares or specialised equity funds.

About the study

Erste Asset Management commissioned the market research bureau Integral to poll Austrians (16 to 69 years) on the topic of digitisation/mega trends. The study is representative for the Austrian population from the age of 16 years and above. A total of n=510 online interviews were held in Austria from 30th of August to 6th of September 2019.

For enquiries, please contact:

Communications & Digital Marketing

Paul Severin

Tel. +43 (0)50 100 19982

E-Mail: paul.severin@erste-am.com

Erste Asset Management GmbH

Am Belvedere 1, A-1100 Wien

www.erste-am.com

Sitz Wien, FN 102018b,

Handelsgericht Wien, DVR 0468703

ERSTE FUTURE INVEST

Disclaimer

This document is an advertisement. Please refer to the prospectus of the UCITS or to the Information for Investors pursuant to Art 21 AIFMG of the alternative investment fund and the Key Information Document before making any final investment decisions. All data is sourced from Erste Asset Management GmbH, unless indicated otherwise. Our languages of communication are German and English.

The prospectus for UCITS (including any amendments) is published in accordance with the provisions of the InvFG 2011 in the currently amended version. Information for Investors pursuant to Art 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in connection with the InvFG 2011.

The fund prospectus, Information for Investors pursuant to Art 21 AIFMG, and the Key Information Document can be viewed in their latest versions at the website www.erste-am.com within the section mandatory publications or obtained in their latest versions free of charge from the domicile of the management company and the domicile of the custodian bank. The exact date of the most recent publication of the fund prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the Key Information Document are available, and any additional locations where the documents can be obtained can be viewed on the website www.erste-am.com. A summary of investor rights is available in German and English on the website www.erste-am.com/investor-rights as well as at the domicile of the management company.

The management company can decide to revoke the arrangements it has made for the distribution of unit certificates abroad, taking into account the regulatory requirements.

Detailed information on the risks potentially associated with the investment can be found in the fund prospectus or Information for investors pursuant to Art 21 AIFMG of the respective fund. If the fund currency is a currency other than the investor's home currency, changes in the corresponding exchange rate may have a positive or negative impact on the value of his investment and the amount of the costs incurred in the fund - converted into his home currency.

Our analyses and conclusions are general in nature and do not take into account the individual needs of our investors in terms of earnings, taxation, and risk appetite. Past performance is not a reliable indicator of the future performance of a fund.

The issue and redemption of unit certificates and the execution of payments to unit holders has been transferred to the Fund's custodian bank/depositary, Erste Group Bank AG, Am Belvedere 1, 1100 Vienna, Austria. Redemption requests can be submitted by investors to their custodian bank, which will forward them to the Custodian Bank/Depositary of the Fund for execution via the usual banking channels. All payments to investors are also processed via the usual banking clearing channel with the investor's custodian bank. In Germany, the issue and return prices of shares are published in electronic form on the web site www.erste-am.com (and also at www.fundinfo.com). Any other information for Shareholders is published in the Bundesanzeiger, Cologne.